Hernando County was established on February 27, 1843.

Hernando County was briefly renamed Benton County in 1844, the county's name was changed back to Hernando in 1850.

Bayport was at one time the county seat.

Until 1856 when it was renamed, Brooksville was known as the town of Melendez.

The county encompasses approximately 37 miles from east to west, 18 miles from north to south and contains approximately 506 square miles or 323,700 acres more or less.

Hernando County is the geographical center of Florida.

Approximately 32% of county land is owned by the government.

Approximately 24% of the county land is agriculturally classified as Greenbelt.

In 2024:

- The Hernando County Property Appraiser's Office managed 127,501 parcels made up of 118,915 Real Property parcels and 8,586 Tangible Personal Property accounts.

- Sales of Single Family homes in 2023 totaled roughly 3,646 with an average sale price of $323,122 up from $316,166 from the prior year.

Please Click here For The Comparison of Taxes Levied

HERNANDO COUNTY POPULATION AND STATISTICS

SOURCESThe Greater Hernando Chamber of Commerce

Hernando County Clerk of the Circuit Court

Hernando County Planning Department

Hernando County Property Appraiser

Section 195.052, Florida Statutes, as amended by the 2008 Florida Legislature (Chapter 2008-197, Laws of Florida) requires that the Department of Revenue and all county property appraisers publish certain county and municipal property tax information on their web sites.

This law requires the Department of Revenue to publish on its web sites certain non-voted property tax information for county and municipal governments.

Please Click here For The Comparison of Taxes Levied

Section 195.052, Florida Statutes, as amended by the 2008 Florida Legislature (Chapter 2008-197, Laws of Florida) requires that the Department of Revenue and all county property appraisers publish certain county and municipal property tax information on their web sites.

This law requires the Department of Revenue to publish on its web sites certain non-voted property tax information for county and municipal governments. Within each county, Table 2 presents the following information for each nonvoted levy by the county and municipal governments:

The table shows the proportion of property taxes paid for each county and municipal nonvoted levy by each of the following property types:

- Residential real property includes single family residential, real property mobile homes, duplexes, triplexes, other multi-family parcels, residential condominiums and those portions of other types of property which are used as a homestead.

- Homestead property

- Non-Homestead

- Vacant lots

- Non-Residential real property includes the following types of property, excluding any portions used as a homestead.

- Commercial improved and vacant

- Industrial improved and vacant

- Institutional/Governmental

- Agricultural

- Other (government leasehold interests, miscellaneous and non-agricultural acreage)

- Tangible Personal Property

- Railroad property centrally assessed by the state

- Percent of total taxes levied for New Construction

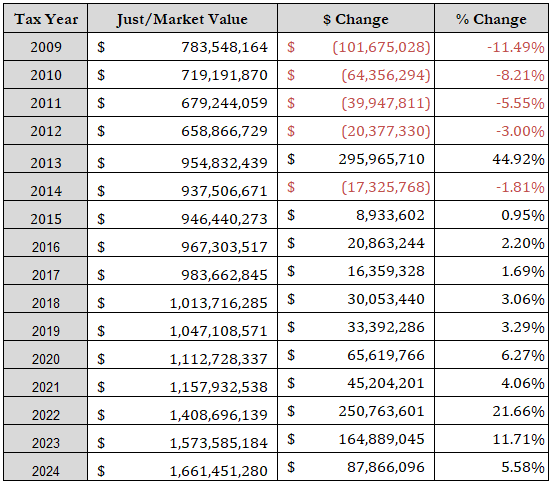

Property Statistics